Homeowners Insurance

Many Americans Are Misinformed About Home, Renters and Auto Insurance Benefits — Here’s What They Need to Know

It’s not unusual for people to be misinformed about homeowners, renters or auto insurance. Myths and misunderstandings are common with insurance benefits and coverage.

Many people, for example, believe that staying with the same insurance carrier over time will always get you a lower rate. And 13% of Americans think home insurance is a waste of money.

ValuePenguin’s latest survey of more than 1,200 people reveals that many Americans have misconceptions about home and vehicle break-ins and thefts, especially around what type of insurance covers those events.

Key findings

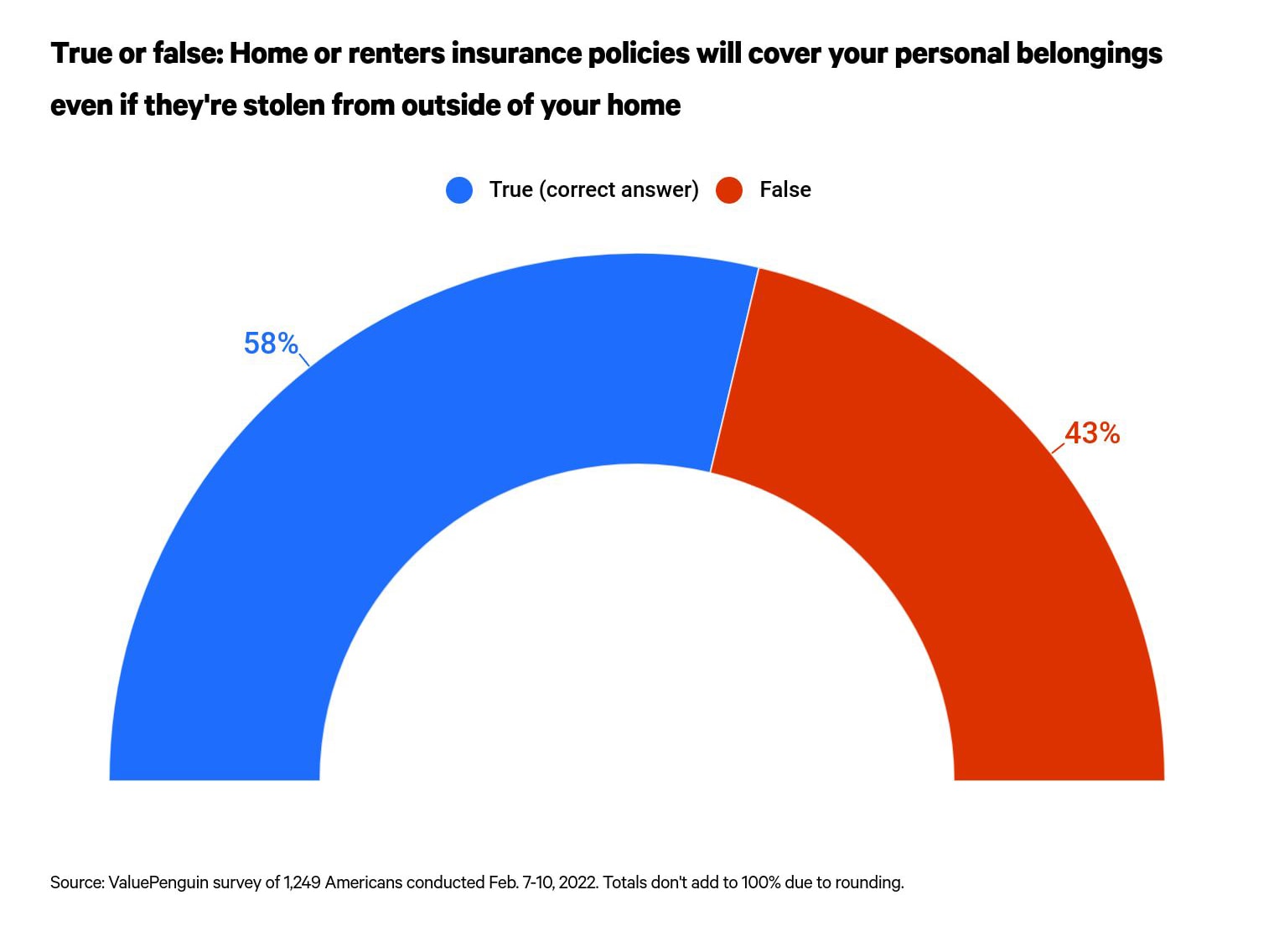

- 43% of Americans don’t know that homeowners or renters insurance covers personal belongings even if they’re stolen outside the home. This misconception is more common among Americans with standard renters insurance (51%) than those with standard home insurance (40%).

- But what happens if the personal belongings are stolen from a car? 69% of Americans wrongly believe auto insurance would cover the belongings. Most Gen Zers (81%) incorrectly believe this, versus 61% of baby boomers — though still a high percentage. As noted, home or renters insurance covers belongings stolen outside the home — even if it’s a laptop or cellphone taken from a vehicle.

- The misconceptions don’t stop there, as nearly 1 in 4 drivers without comprehensive auto insurance wrongly believe they would be covered for car theft or theft-related damage. Collision insurance only covers accident-related damage, while comprehensive insurance is needed to cover a stolen car or any damage done during a theft.

- Personal items are the No. 1 thing most likely to be stolen from a vehicle, according to the 19% of Americans who have experienced an auto-related break-in or theft. In nearly half of the cases (48%), items such as purses, laptops, cellphones and cash were stolen — which would only be covered by a home insurance policy.

- Despite all this, many Americans are more vulnerable to becoming victims. Notably, 78% don’t have motion sensors outside their home, 38% don’t lock their front door while at home, 16% sometimes leave their car unlocked and 10% occasionally leave their wallet in their vehicle.

Misconceptions about home, renters and auto insurance benefits

A renters or homeowners insurance policy might cover you when someone steals your personal belongings — even if the theft occurs outside of the home. Yet 43% of Americans don’t realize that’s the case.

This misconception about insurance benefits pertaining to belongings stolen outside of the home is highest among Gen Zers ages 18 to 25 (49%) and lowest among baby boomers ages 57 to 76 (38%). Meanwhile, more people with standard renters insurance (51%) are confused regarding their coverage for stolen belongings than homeowners with standard home insurance policies (40%).

As for personal items stolen from inside your vehicle, the confusion grows. Most people (60% of respondents) mistakenly believe that comprehensive auto insurance will cover them in this situation. Those without home or renters insurance are most likely to have this misconception (75% of renters without renters insurance and 84% of homeowners without homeowners insurance).

In reality, it’s your home or renters insurance policy that provides coverage for belongings stolen from your car. Yet only 31% of people understand this.

Most people (69%) do realize that comprehensive auto insurance may protect them if their vehicle is stolen or damaged during a break-in. But nearly 25% of those with collision auto insurance wrongly believe they’re covered in these situations.

There are subtle differences in the knowledge gap on this subject depending on a person’s income bracket. The percentage of people who have an incorrect belief that collision auto insurance provides coverage for car theft or damage during a break-in is as follows:

- Less than $35,000: 20%

- $35,000 to $49,999: 22%

- $50,000 to $74,999: 16%

- $75,000 to $99,999: 9%

- $100,000 and up: 12%

More than 1 in 10 think home, renters insurance are a waste of money

When asked whether homeowners or renters insurance is worthwhile, 87% agree it’s important. Yet that means that a surprising 13% believe this coverage isn’t worth the cost.

Roughly the same percentage of men (12%) and women (13%) believe that homeowners or renters insurance is a waste of money. And it’s a belief also held by 33% of homeowners without home insurance and 28% of renters without renters insurance.

There are notable differences between how members of different age groups feel about the topic. About 1 in 5 (17%) Gen Zers, more than any other generation, believe that securing homeowners or renters insurance isn’t a good use of their money.

30% of Americans have been victims of home, car break-ins

Home and car break-ins are a crime that most Americans haven’t experienced. But 30% have been victims of theft or burglary in their home or vehicle.

One in 10 Americans experienced a home break-in at some point before the coronavirus pandemic. However, the percentage of Americans who have been victims of home break-ins at some point during the pandemic is just 6%. (To be clear, respondents could select any response that applied, so it’s possible that some could have been victimized both before and during the pandemic.)

Meanwhile, respondents’ vehicle theft and burglary percentages are 14% before the pandemic and 5% during the pandemic.

Here’s a deeper look at the types of belongings that were stolen when home and car break-ins occurred. You’ll also find details about whether the victims of these crimes filed police reports or submitted insurance claims.

Home break-ins

Among the 188 respondents who were victims of home break-ins, almost 20% didn’t have anything stolen. Yet the vast majority of victims did experience the theft of personal belongings.

Types of items stolen during home break-ins | |

|---|---|

| Electronics (TVs, laptops, etc.) | 42% |

| Jewelry | 36% |

| Cash | 36% |

| Designer handbags or clothing | 15% |

| Prescription drugs | 12% |

| Guns or firearms | 11% |

| Other | 9% |

| Art or home decor | 5% |

A little more than half of the victims of home break-ins (51%) filed both a police report and an insurance claim after the crime occurred. However, 34% filed only a police report and 16% opted not to report the theft at all to either the police or their insurance provider.

Out of those who did file a claim with their insurance provider, 36% say their insurance policy covered all their losses. And 17% of home break-in victims say insurance provided compensation that went above and beyond the value of their lost or stolen belongings. Another 7%, however, report receiving zero compensation despite submitting an insurance claim.

Car break-ins

There were 233 respondents in the ValuePenguin survey who indicated they had been victims of a vehicle theft or break-in. Less than 1 in 7 (13%) report the criminals didn’t steal anything from them in these instances.

Types of items stolen during vehicle break-ins | |

|---|---|

| Personal items (cellphones, laptops, purse, cash, etc.) | 48% |

| Stereo system | 22% |

| Vehicle | 21% |

| Vehicle parts | 11% |

| Other | 10% |

| License plate | 8% |

| Keys | 6% |

| Car registration | 5% |

| GPS system | 4% |

Just 4 in 10 victims of these crimes filed both a police report and an insurance claim after the fact. And at 30% each, the percentage of victims who filed just a police report was equal to the percentage of those who chose not to report the break-in event in any capacity (insurance claim or police report).

For those who did file insurance claims to request compensation for their losses, 23% say they received full reimbursement. Meanwhile, 8% of victims report their insurance provider compensated them for even more than the amount lost. At the other end of the spectrum, however, 9% of car break-in victims say their insurance company didn’t cover any of the losses they experienced.

Many Americans more vulnerable to becoming victims

Certain habits can make you more vulnerable to theft, burglary and similar crimes. For example, the 16% of Americans who sometimes fail to lock their cars and the 7% who leave their keys in their vehicle from time to time may be more likely to become victims of car break-ins.

Here’s a closer look at the habits people report having that could expose them to potential problems from people with bad intentions.

Men and women generally report the same habits. For example, 16% of men and women sometimes leave their cars unlocked. And 15% of women don’t always lock the door when they’re not home, compared with 12% of men.

Methodology

ValuePenguin commissioned Qualtrics to conduct an online survey of 1,249 consumers Feb. 7-10, 2022. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. All responses were reviewed by researchers for quality control.

We defined generations as the following ages in 2022:

- Generation Z: 18 to 25

- Millennial: 26 to 41

- Generation X: 42 to 56

- Baby boomer: 57 to 76

While the survey also included consumers from the silent generation (those 77 and older), the sample size was too small to include findings related to that group in the generational breakdowns.