Average Monthly Mortgage Payments

The median monthly mortgage payment for American homeowners was $1,030, according to the US Census Bureau's 2015 American Housing Survey. The survey also reported aggregate monthly housing costs totaling $1,492 for homeowners with a mortgage. This figure typically includes property taxes, which vary based on state and city, and property insurance, which varies based on the home’s cost. You can see how your potential mortgage payment compares by using the form above.

Average Mortgage Payments in the US

Monthly mortgage payments are largely determined by the size of a loan. In general, high-income consumers who take out bigger mortgages will pay more in lifetime interest than lower-income consumers. Still, smaller loans generally have the higher interest rates, as do loans drawn by borrowers with poor credit scores. As expected, higher interest rates also lead to larger monthly payments as a whole.

Monthly Mortgage Payments by Region

The census data we reviewed allowed us to compare mortgage payments across different regions of the country. We found that median payments in 2015 were roughly 35 to 40 percent higher for Northeast and Western states than in the Midwest or the South.

Region | Median Monthly Payment | Median Interest Rate | Median Income | Median Outstanding Debt |

|---|---|---|---|---|

| Northeast | $1,200 | 4% | $80,123 | $135,000 |

| Midwest | $840 | 4% | $65,960 | $100,000 |

| South | $890 | 5% | $62,554 | $102,000 |

| West | $1,243 | 4% | $75,520 | $180,000 |

While mortgage interest rates were similar for all regions, this did not correlate with similarities in payment amounts. In the wealthiest regions of the country, the Northeast and West, consumers had larger outstanding balances on their mortgages and made higher monthly payments. In the South, where median annual income was the lowest, mortgages had the highest interest rates, leading to payments slightly higher than in the Midwest.

Average Mortgage Payment Amounts by Income

Breaking down mortgage payment information by incomes showed that median payments were larger for census respondents in higher income brackets. This stood in contrast to the fact that median interest rates were highest among borrowers earning $10,000 to $40,000. People earning more than $40,000 had a median interest rate of 4%, a significantly lower rate for mortgages.

Income | Median Monthly Payment | Median Interest Rate | Median Outstanding Debt |

|---|---|---|---|

| Less than $10,000 | $635 | 4% | $60,000 |

| $10,000 to $19,999 | $607 | 5% | $62,000 |

| $20,000 to $29,999 | $631 | 5% | $63,000 |

| $30,000 to $39,999 | $700 | 5% | $78,000 |

| $40,000 to $49,999 | $769 | 4% | $87,000 |

| $50,000 to $59,999 | $850 | 4% | $90,010 |

| $60,000 to $79,999 | $927 | 4% | $102,000 |

| $80,000 to $99,999 | $1,024 | 4% | $125,000 |

| $100,000 to $119,999 | $1,200 | 4% | $140,000 |

| $120,000 or more | $1,600 | 4% | 200,000 |

Monthly mortgage payments increase with income, as wealthier consumers are likely to take out larger loans to buy more expensive homes. For the wealthiest Americans making over $120,000 a year, the median monthly mortgage payment was $1,600 in 2015, compared to $607 for those making $10,000 to $19,999. On the other hand, interest rates are higher for those who make less money, likely because interest rates are typically higher on smaller loans.

Average Monthly Mortgage Payments by Age Group

Until the 45 to 54 age group, borrower age had a positive correlation with the median size of mortgage payments in 2015. Median payments increased for each successive working-age group, reaching their peak among people between 35 and 44 and declining for age groups with more retirees.

Age | Median Monthly Payment | Median Income | Median Outstanding Debt |

|---|---|---|---|

| Under 25 | $780 | $25,000 | $105,000 |

| 25 to 29 | $950 | $54,000 | $129,000 |

| 30 to 34 | $1,096 | $57,000 | $140,000 |

| 35 to 44 | $1,192 | $63,000 | $150,000 |

| 45 to 54 | $1,100 | $67,752 | $130,000 |

| 55 to 64 | $989 | $57,200 | $99,991 |

| 65 to 74 | $881 | $42,000 | $93,000 |

| 75 and up | $696 | $27,122 | $71,000 |

Borrowers of working age, in the 25 to 64 year old range, made monthly mortgage payments of close to $1,000. Consumers under 25 are likely able to afford a less expensive home than older professionals, and make a median monthly mortgage payment of under $800. Mortgage holders over 64 are likely retired and have either paid down their mortgage or are spending on a less expensive home, leading to a lower median payment for this group.

Breakdown of the Average Mortgage Payment

In 2015, the average American homeowner spent about $1,800 on paying down the principal on their loans and nearly $8,000 on mortgage interest and related charges, a combined monthly average of about $820. The bulk of each payment is split between paying interest and paying principal. As time goes by, the portion of money going towards interest decreases while the amount put towards reducing principal increases—a process called amortization.

Principal

The principal cost of a mortgage refers to the initial amount borrowed by a consumer for their home purchase. In 2015, the average American homeowner carried $120,000 in remaining mortgage debt, also known as "principal."

The largest group of borrowers were those who owed between $80,000 and $149,999 in remaining principal. Depending on the amortization schedule of the mortgage, each monthly payment decreases the remaining principal until the outstanding balance reaches zero at the end of a predefined period. The most common type of mortgage works on a 30-year fixed rate term, consisting of 360 monthly payments.

Interest

The median APR for all mortgages issued in the US was 4% as of 2015. However, APR as a value does not take into account the effect of compounding interest, which results in higher interest rates that vary according to the particular compounding schedule of a given loan. In short, two mortgages advertised as having the same APR may end up costing different amounts in total interest because the balance is compounded at different intervals.

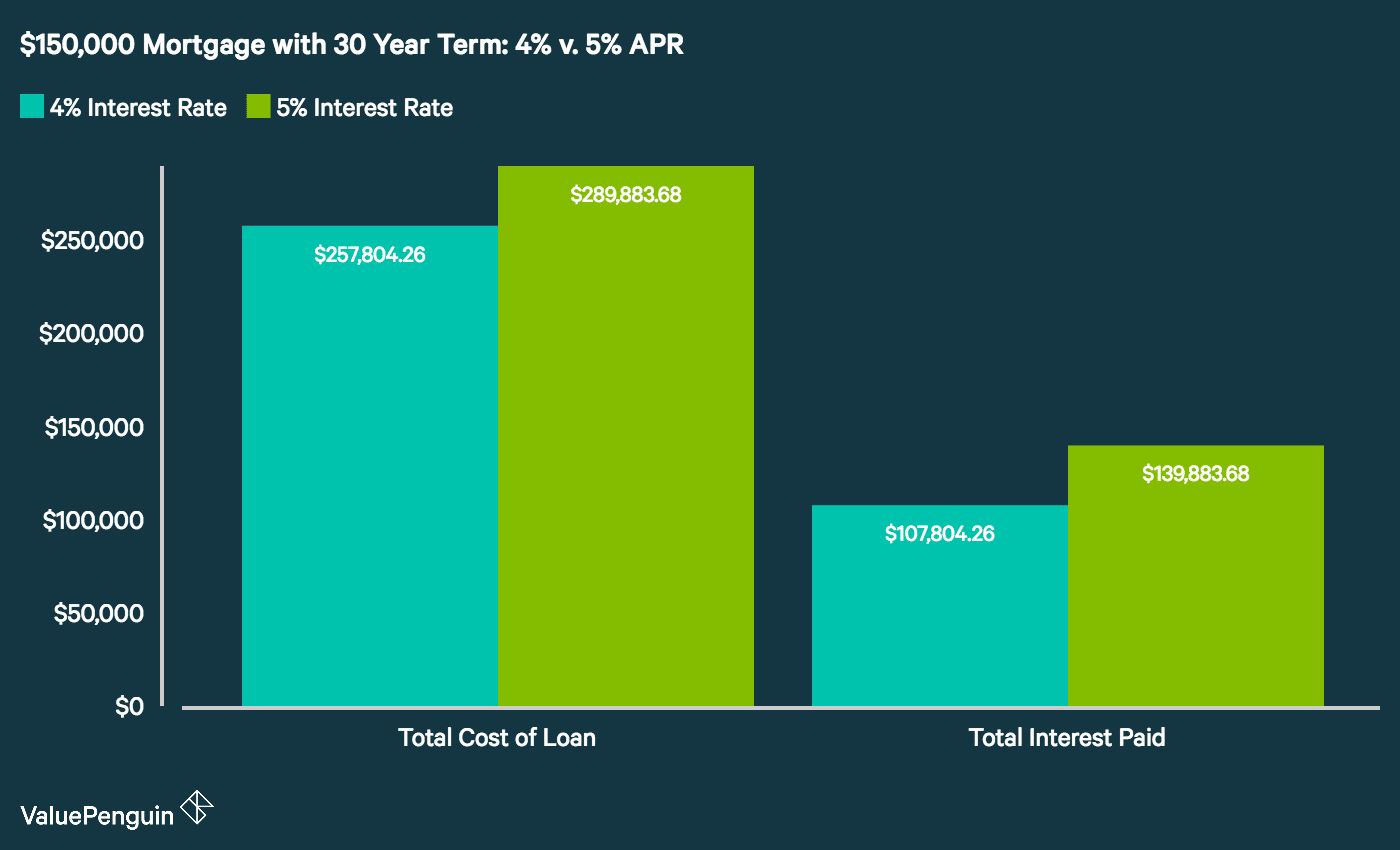

For example, to finance the purchase of a $215,500 home, the median in 2015, a consumer drawing a 30-year mortgage of $150,000 with a 4% interest rate would make average monthly payments of $716.12, each month increasing the amount of principal they pay, and decreasing the total balance and the interest. On the other hand, a 30-year mortgage in the same $150,000 sum, but with a 5% interest rate, will result in average monthly payments of $805.23.

Mortgages can come with either fixed or variable rates. Nearly 90% of all outstanding mortgages are fixed-rate, and over 60% carry interest rates between 3.0% and 4.9%. This implies that more than half of existing mortgages were originated in 2010 or later, a period of historically low interest rates. In the current low-rate environment, getting a fixed-rate mortgages will guarantee that you maintain relatively low interest costs throughout the lifetime of your mortgage.

Sources:

American Housing Survey, Census Bureau American FactFinder, Bureau of Labor Statistics

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.