The Best Cheap Motorcycle Insurance in Hawaii

Progressive has the cheapest motorcycle insurance in Hawaii, at $26 per month.

Compare motorcycle insurance quotes in Hawaii

Best cheap Hawaii motorcycle insurance

To help you find the best cheap motorcycle insurance in Hawaii, ValuePenguin compared quotes from top companies across 37 of the largest cities across the state.

Our experts rated the best motorcycle insurance companies in Hawaii based on cost, customer service and coverage availability.

To find the cheapest companies, we compared rates for a full coverage policy with collision and comprehensive coverage, plus higher liability limits than the state requirement. Full methodology.

Cheapest motorcycle insurance in Hawaii

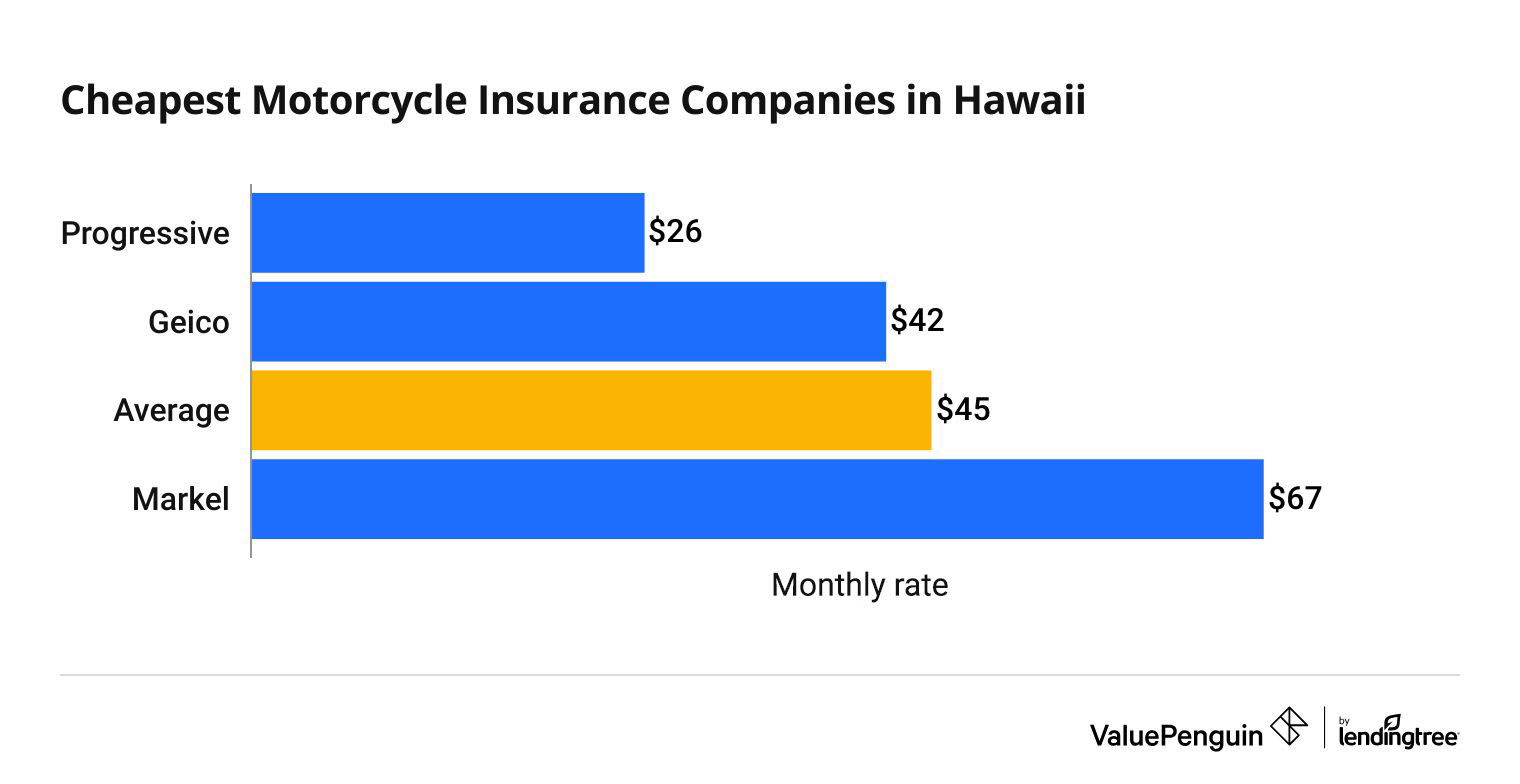

Progressive offers the cheapest motorcycle insurance quotes in Hawaii.

A full coverage policy from Progressive costs around $26 per month. That's $19 per month less than the statewide average.

Compare motorcycle insurance quotes from providers in Hawaii

The average cost of motorcycle insurance in Hawaii is $45 per month, or $541 per year for full coverage. That's 35% more expensive than the national average of $33 per month.

Hawaii motorcycle insurance quotes

Company | Monthly rate | ||

|---|---|---|---|

| Progressive | $26 | ||

| Geico | $42 | ||

| Markel | $67 | ||

Best motorcycle insurance for most people: Progressive

-

Editor rating

-

Monthly rate

$26 ?

Pros and cons

Progressive has the cheapest motorcycle insurance rates in Hawaii, great coverage options and customer service.

Motorcycle insurance from Progressive costs just $26 per month, or $314 per year, for full coverage. That's 42% cheaper than the Hawaii average, and $16 per month less than the second-cheapest option, Geico.

Progressive's basic policy includes coverage that most companies charge extra for. A standard policy from Progressive includes:

- Custom parts and accessories coverage: Progressive includes $3,000 of coverage for after-market upgrades when you get comprehensive and collision coverage. This can include items such as a custom saddle or stereo system.

- Full replacement cost coverage: Progressive will fix your bike using brand-new parts after an accident, regardless of any prior wear and tear.

- Original equipment manufacturer parts coverage: Progressive will repair your bike using original manufacturer parts, or the best parts available. That means you won't have to settle for after-market parts after a crash.

Progressive also offers coverage add-ons like roadside assistance and new bike replacement. And, it protects many types of bikes, including scooters, mopeds, ATVs and dirt bikes.

However, Progressive doesn't offer bikers rental reimbursement coverage. That means you'll have to pay for a rental vehicle while your bike is in the shop after an accident.

Progressive customers can expect a quick and easy claims process after an accident. The company gets 35% fewer complaints than other major insurance companies, according to the National Association of Insurance Commissioners (NAIC). This suggests that customers tend to be satisfied with their service.

Best for bikers with military ties: USAA

-

Editor rating

-

Monthly rate

$25 ?

Pros and cons

The best way for members of the military and their families to save on motorcycle insurance is to go through USAA.

USAA partners with Progressive to offer excellent motorcycle insurance coverage at a very affordable rate. However, only military members, veterans and some of their family members can get motorcycle insurance through USAA.

Progressive offers Hawaii's cheapest motorcycle insurance, and USAA members get an additional 5% discount. That works out to an average cost of $25 per month for a full coverage policy from Progressive.

USAA has a reputation for having some of the best customer service in the business. That means bikes can expect USAA to get them back on the road quickly after an accident.

USAA members also get access to all the great coverage options offered by Progressive. Full coverage motorcycle insurance from Progressive includes extra coverage that will leave your bike in like-new condition after a crash.

Hawaii motorcycle insurance costs by city

Pearl City, a community in Honolulu, has the most expensive motorcycle insurance quotes in Hawaii, at $50 per month.

However, motorcycle insurance rates in Hawaii don't vary much between cities. Riders in 18 of the 41 largest cities and towns across Hawaii pay the cheapest rates in the islands, at $43 per month for full coverage.

City | Monthly cost | % from average |

|---|---|---|

| Aiea | $50 | 10% |

| Ewa Beach | $46 | 2% |

| Haleiwa | $46 | 2% |

| Hauula | $46 | 2% |

| Hilo | $43 | -4% |

Motorcycle insurance rates tend to be more expensive in large, densely populated cities. That's because cities typically have more traffic congestion and higher crime rates, which lead to more insurance claims.

For example, bike insurance in Honolulu costs $47 per month, which is 5% more than the state average.

Hawaii motorcycle insurance requirements

Hawaii bikers must have a minimum amount of bodily injury and property damage liability insurance to ride legally. This requirement may be referred to as 20/40/10. This is the same amount of insurance required for private passenger vehicles in Hawaii.

- Bodily injury liability: $20,000 per person and $40,000 per accident

- Property damage liability: $10,000 per accident

These coverages only protect other drivers from damage for which you're responsible. You'll have to get collision and comprehensive coverage to protect your bike. You should consider this extra coverage if you can't afford to replace your bike after a major accident, especially if it's your only vehicle.

How do you get a motorcycle license in Hawaii?

You must get a learner's permit before qualifying for a Class 2 motorcycle license or endorsement in Hawaii. This class of license applies to both motorcycles and motor-powered scooters.

You must pass a vision test and two written tests to get a permit. One is for operating a motorcycle and the other is a rules of the road exam. You don't have to take the second test if you have a regular driver's license. Once you have a learner's permit, you must complete a skill test before it expires.

Frequently asked questions

How much is motorcycle insurance in Hawaii?

The average cost of motorcycle insurance in Hawaii is $541 per year, or $45 per month for full coverage. However, riders in Hawaii can find much cheaper rates with Progressive. A policy from Progressive costs $26 per month, on average.

Do you need insurance for a motorcycle in Hawaii?

Yes, you must have at least $20,000 of bodily injury liability coverage per person and $40,000 per person to ride a motorcycle in Hawaii legally. You must also have $10,000 of property damage liability coverage.

How much is bike insurance in Honolulu?

Motorcycle insurance in Honolulu costs an average of $47 per month for full coverage. That's $2 per month more than the Hawaii average. Honolulu riders may find cheaper rates at Progressive, where a policy costs around $30 per month.

Methodology

To find the best cheap motorcycle insurance in Hawaii, ValuePenguin collected quotes from three top insurance companies across 41 of the largest cities and towns throughout Hawaii's islands. Rates are for a 45-year-old single man who owns a 2018 Honda CMX500 Rebel.

Quotes are for a full coverage policy, which includes higher liability limits than the state requirement, along with comprehensive and collision coverage.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Uninsured and underinsured motorist property damage: $25,000 per accident

- Medical payments: $5,000

- Comprehensive and collision deductible: $500

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.