Auto-Owners Insurance Review

Auto-Owners is a great choice for people who want reliable customer service and don't mind working with an agent.

Find Cheap Auto Insurance Quotes in Your Area

Auto-Owners has very affordable car insurance rates. Its home insurance tends to be pricey, but it offers lots of ways to personalize your protection. That makes Auto-Owners a good choice for people who want their insurance to cover most types of damage.

The biggest downside to Auto-Owners is that it's only available in 26 states. In addition, you can only buy Auto-Owners insurance through independent agents. So you can't compare quotes online.

Editor's rating breakdown | |

|---|---|

| Price | |

| Coverage | |

| Customer service | |

| Unique value | |

Pros and cons of Auto-Owners insurance

Pros

Cheap car insurance

Dependable customer service

Lots of coverage options and discounts

Cons

Expensive home insurance

Only available in 26 states

Can't compare quotes online

Auto-Owners car insurance

Auto-Owners offers affordable car insurance quotes and lots of coverage options. That makes it a great choice for most drivers.

Auto-Owners car insurance quotes

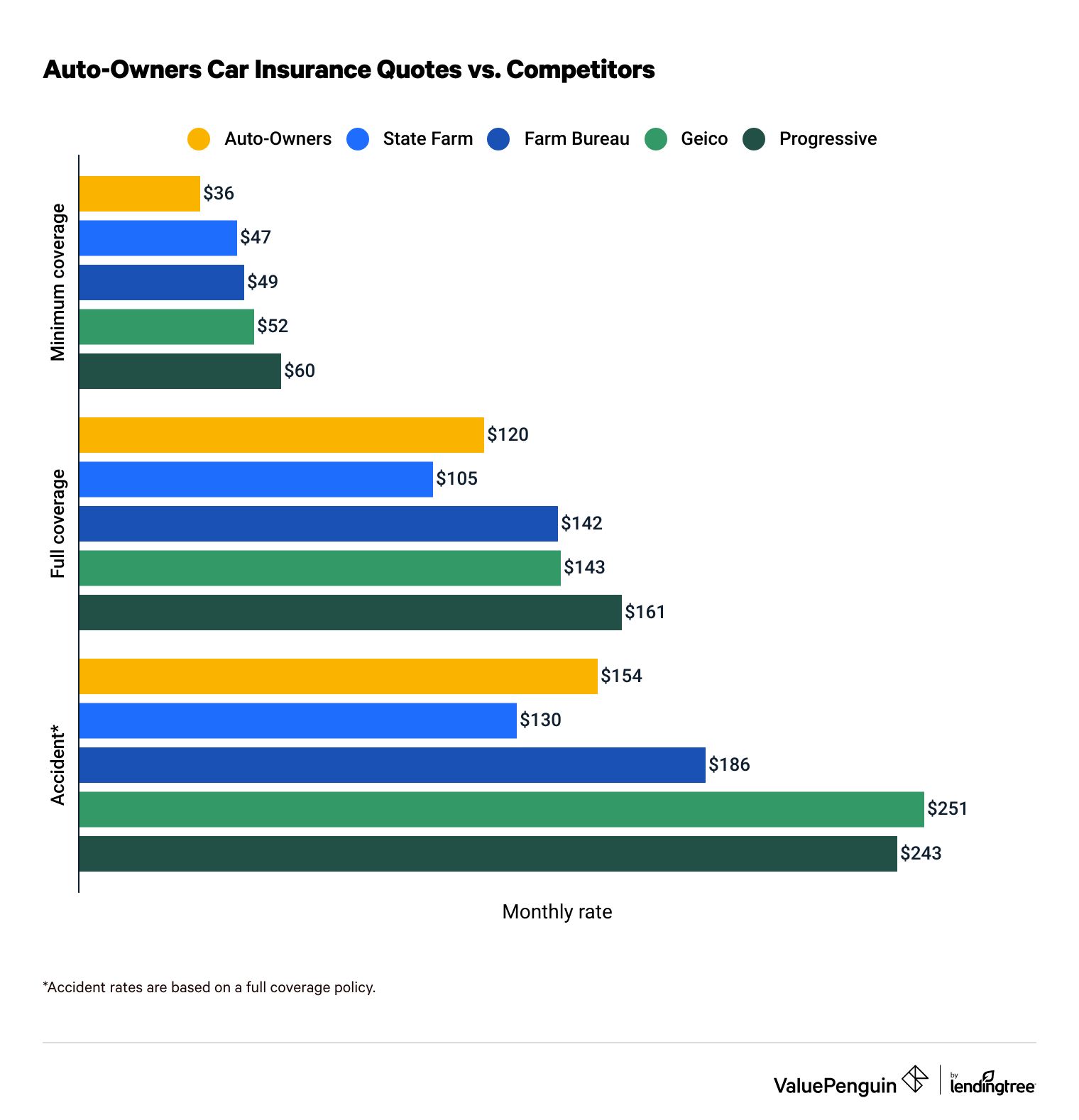

Auto-Owners rates are 16% cheaper than average for a full coverage policy, at $120 per month. Minimum coverage from Auto-Owners costs $36 per month, which is 32% cheaper than average.

Find Cheap Auto Insurance Quotes

Even after one accident, Auto-Owners still costs 26% less than average. Full coverage rates go from $120 per month to $154 per month, a $34 increase.

In comparison, rates from Geico increase by $109 per month.

Average monthly car insurance quotes

Minimum coverage

Full coverage

Full coverage after an accident

Company | Monthly rate | ||

|---|---|---|---|

| Auto-Owners | $36 | ||

| State Farm | $47 | ||

| Farm Bureau | $49 | ||

| Geico | $52 | ||

| Progressive | $60 | ||

Minimum coverage

Company | Monthly rate | ||

|---|---|---|---|

| Auto-Owners | $36 | ||

| State Farm | $47 | ||

| Farm Bureau | $49 | ||

| Geico | $52 | ||

| Progressive | $60 | ||

Full coverage

Company | Monthly rate | ||

|---|---|---|---|

| State Farm | $105 | ||

| Auto-Owners | $120 | ||

| Farm Bureau | $142 | ||

| Geico | $143 | ||

| Progressive | $161 | ||

Full coverage after an accident

Company | Monthly rate | ||

|---|---|---|---|

| State Farm | $130 | ||

| Auto-Owners | $154 | ||

| Farm Bureau | $186 | ||

| Progressive | $243 | ||

| Geico | $251 | ||

Auto-Owners doesn't offer online quotes. You'll have to contact a local independent insurance agent to compare rates.

Auto-Owners auto insurance discounts

Auto-Owners Insurance offers common car insurance discounts. The list includes a discount for bundling multiple policies, paying your bill early and driving safely.

These discounts, plus Auto-Owners' already low rates, mean your rate could be even cheaper.

- Multi-policy discount: Buy additional policies, like home or life insurance.

- Multi-car discount: Insure two or more cars on your policy.

- Favorable loss history discount: Have a good claims history. For example, if you haven't caused an accident in the last three to five years, you could save money.

- Paid in full discount: Pay your annual bill in advance and on time.

- Safety discounts: Have safety features like airbags and car alarms.

- Green discount: Receive statements via email and pay your bills online.

- Advance quote discount: Get a quote before the effective date of your new policy.

Auto-Owners also offers a number of discounts for teen drivers.

- Good student discount: Young drivers can save up to 20% if you maintain a B average or better in school.

- Teen driver monitoring discount: Parents can save money if their teen driver has a GPS monitoring unit installed in their car or downloads an app on their phone.

- Student away at school discount: Parents can get a discount if your student goes to school more than 100 miles away from home and doesn't bring their car.

Auto-Owners car insurance coverages and features

Auto-Owners offers several extra coverage add-ons that drivers can use to increase your protection.

Its rental car reimbursement program, called "additional expense," stands out because it helps pay for a hotel and food if you're in an accident far from home. Most major companies don't include these expenses in rental car reimbursement coverage. This coverage also pays for a rental car while your car is in the shop after an accident.

Accident forgiveness

Accident forgiveness prevents your car insurance rates from going up after you cause an accident. Auto-Owners offers this option to drivers with no at-fault claims or major violations for three years or longer.

Diminished value

Diminished value coverage helps protect the money you've invested in your car. After an accident, your car may lose value — even after it's repaired. If you have diminished value coverage, Auto-Owners will pay you the difference between how much your car was worth before the accident and its current value.

This coverage could be helpful if you get a new car every few years and need to protect its trade-in value.

Gap insurance

Loan or lease gap insurance pays the difference between your car's current value and the amount you owe on your loan if it's totaled in an accident.

Rental car gap coverage

Rental auto gap coverage pays for any damages you're responsible for under a rental car agreement if you cause an accident.

Roadside assistance

Auto-Owners roadside assistance helps schedule and pay for towing, a flat tire change or minor mechanical issue if your car breaks down on the side of the road. Auto-Owners calls this coverage "road trouble service."

Additionally, Auto-Owners provides standard collision and comprehensive coverages. These coverages help pay for damage to your own car after an accident, regardless of whose fault it is.

But there are a few extra benefits when compared with other companies' coverages.

Auto-Owners also offers all the standard and optional coverages you expect. This includes bodily injury and property damage liability, medical payments and personal injury protection.

Auto-Owners classic car insurance

Auto-Owners offers special protection for classic and antique cars.

Classic car policies are typically based on an agreed value that you and the insurance company decide together. That's because the value of a classic car can be based on a number of different factors, like the popularity of a certain year or the way it's been restored.

Classic car owners can get discounts from Auto-Owners if you don't drive your car often or only take it to car shows. You can also save with a multi-car discount if you insure your other vehicles with Auto-Owners.

Auto-Owners homeowners insurance

Home insurance from Auto-Owners tends to be expensive. But it could be worth it if you qualify for discounts or need extra protection.

Auto-Owners homeowners insurance quotes

Homeowners insurance from Auto-Owners costs $2,155 per year, on average. That's 19% more expensive than competitors.

Find Cheap Homeowners Insurance Quotes in Your Area

However, the price of home insurance varies depending on where you live.

Auto-Owners has the cheapest home insurance quotes in Michigan, where a policy only costs $249 per year. But in Minnesota, home insurance from Auto-Owners costs around $4,062 per year. That makes it the most expensive option in the state.

That's why it's important to compare quotes from a few companies to find the cheapest home insurance near you.

Average annual home insurance quotes

Company | Annual rate | ||

|---|---|---|---|

| Allstate | $1,440 | ||

| State Farm | $1,476 | ||

| American Family | $1,594 | ||

| Farmers | $1,612 | ||

| Auto-Owners | $2,155 | ||

Auto-Owners home insurance discounts

Auto-Owners offers more home insurance discounts than most other companies.

This could make its high rates more affordable for homeowners who qualify for multiple discounts.

- Advance quote discount, if you get a quote before the start date of your new policy.

- Automatic backup generator discount, if you have a qualifying generator.

- Green discount, if you opt to get your statements via email and pay your bills online.

- Favorable loss discount, if you haven't made a home insurance claim in the recent past.

- Mortgage-free discount, if you don't have a mortgage or line of credit on your home.

- Multi-policy discount, if you also buy a car or life insurance policy from Auto-Owners.

- Paid in full discount, if you pay your entire annual premium up front and on time.

- Payment history discount, if you've paid your home insurance bill on time for the past three years.

- Protective devices discount, if you have safety features like smoke detectors, fire extinguishers and deadbolt locks.

- Water shutoff device discount, if you have a whole-home water shutoff system that turns your water off if you have a leak.

Auto-Owners homeowners insurance coverage

Auto-Owners gives customers lots of ways to increase their protection with coverage add-ons. This makes it a great option for people who want to make sure their insurance covers most types of damage.

Equipment breakdown

Equipment breakdown helps pay to repair or replace equipment if it's damaged due to an electrical or mechanical failure. This can include things like your air conditioner, fridge or computer.

Guaranteed replacement cost

Guaranteed replacement cost pays to rebuild your home after a total loss, even if it costs more than your dwelling coverage limit.

Home cyber protection

Home cyber protection helps pay for a professional to recover stolen or corrupted data and fix your computer if it's been hacked. It also pays for an attorney if you need to file a lawsuit, and any financial loss from identity theft.

Identity theft coverage

Identity theft coverage pays up to $15,000 to help you restore your identity if it's stolen.

Inland flood coverage

Inland flood coverage protects your home's structure and your belongings from flooding. It will pay to move your belongings to a safe location before a flood hits, and remove debris afterwards. If you need to move while repairs are being made, inland flood coverage also pays for your living expenses. That can include moving expenses or the cost of a rental home.

Inland flood coverage from Auto-Owners is only available if your home is in a low- to moderate-risk flood zone.

Ordinance or law coverage

Ordinance or law coverage pays to bring your home up to current building codes if it's damaged and needs repairs. This coverage can be helpful if you own an older home that may need extra repairs to pass an inspection.

Special personal property coverage

Special personal property coverage gives you extra protection for valuable items, like jewelry or artwork.

For example, if you list your engagement ring under "special personal property" and it's lost on vacation, Auto-Owners will pay to replace it. In comparison, a standard home insurance policy doesn't cover lost jewelry.

Water backup coverage

Water backup coverage pays for repairs if your home is damaged by backed up pipes or sewers, or a broken sump pump.

Auto-Owners also offers an upgraded home insurance package called "Homeowners Plus." It includes coverage for damage to your home due to appliance leaks, food spoilage after a power outage and more.

Auto-Owners customer service

Auto-Owners customers are typically happy with the company's customer service.

Auto-Owners receives far fewer complaints than other similar-sized insurance companies, according to the National Association of Insurance Commissioners (NAIC).

Auto-Owners Insurance ratings

Reviewer | Score |

|---|---|

| NAIC auto insurance score | 0.49 |

| NAIC home insurance score | 0.13 |

| J.D. Power auto claims survey | 15th of 22 |

| J.D. Power home insurance survey | 9th of 20 |

| A.M. Best Financial Strength Rating | A++ |

The National Association of Insurance Commissioners (NAIC) Complaint Index rates insurance companies based on the number of complaints they receive in relation to their size. The average score is 1.00, and lower is better.

In addition, Auto-Owners has excellent financial stability. The company earned an A++ Financial Strength Rating from A.M. Best, which is the highest rating available. This means Auto-Owners has a strong ability to pay claims. It also suggests that the company will be around to protect its customers for a long time.

However, J.D. Power isn't as impressed with the service from Auto-Owners. The company barely earned an above-average score for its home insurance customer service. And Auto-Owners auto insurance claims experience was ranked 15th out of 22 companies.

In many respects, Auto-Owners Insurance is an old-fashioned company. The only way to buy a policy is through an independent agent who lives and works in your area. Most of the interaction you have with the company is through your agent, not with a call center or online.

For those who prefer to have a dedicated agent, this is a strong plus. For instance, your agent can help you with policy questions or claims. And you'll have peace of mind knowing that someone you trust is working to get your life back to normal quickly in an emergency.

Auto-Owners also offers most of the standard customer service options that are commonly available. That includes online billing and account access, a mobile app and 24-hour roadside assistance.

However, customers who want to manage their policy online should consider another company. Your agent needs to help you make a claim, change your policy or cancel your insurance. If your claim is urgent and your agent isn't available, you can call Auto-Owners on a 24-hour hotline.

Contact Auto-Owners Insurance

Auto-Owners customers are typically best off contacting their local insurance agent about any policy questions or to file a claim. If your agent isn't available, you can call the:

- Auto-Owners customer service phone number, at (800) 346-0346.

- Auto-Owners after hours claims phone number, at (888) 252-4626.

- Auto-Owners roadside assistance phone number, at (888) 869-2642.

Frequently asked questions

Is Auto-Owners a good insurance company?

Yes, Auto-Owners is a good insurance company. It has very affordable car insurance rates and well-rated customer service from its network of independent agents. However, you can't get a quote online, and home insurance rates can be expensive if you don't qualify for discounts.

Where is Auto-Owners available?

Auto-Owners is available in 26 states: Alabama, Arkansas, Arizona, Colorado, Florida, Georgia, Iowa, Idaho, Illinois, Indiana, Kansas, Kentucky, Michigan, Minnesota, Missouri, North Carolina, North Dakota, Nebraska, Ohio, Pennsylvania, South Carolina, South Dakota, Tennessee, Utah, Virginia and Wisconsin.

Is Auto-Owners expensive?

Car insurance from Auto-Owners tends to be cheaper than average. A full coverage policy costs around $120 per month, which is 16% less than competitors.

But home insurance from Auto-Owners can be pricey. On average, home insurance from Auto-Owners costs $2,155 per year, which is 19% more expensive than average,

What is the A.M. Best rating for Auto-Owners?

Auto-Owners has an A++ Financial Strength Rating from A.M. Best. That means it has an excellent ability to pay customer claims, even if it receives a lot of claims over a short time period.

Methodology

To compare car insurance quotes from Auto-Owners, ValuePenguin gathered thousands of quotes from across ZIP codes in 12 states. Rates are for a 30-year-old single man with a clean driving record who owns a 2015 Honda Civic EX.

Full coverage rates include higher liability limits than the state requirement, along with comprehensive and collision coverage.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $25,000 per accident

- Personal injury protection: Minimum required by state

- Medical payments: $10,000

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Comprehensive and collision deductible: $500

To compare home insurance quotes from Auto-Owners, ValuePenguin collected thousands of quotes from across ZIP codes in 13 states. Rates are for a 45-year-old married man with a good credit score and no history of home insurance claims.

Dwelling coverage is based on the median home age and value for each individual state. Quotes also include $100,000 of personal liability coverage, $5,000 of medical payments coverage and a $1,000 deductible.

Quote data was sourced from Quadrant Information Services. These rates were publicly sourced from insurance company filings and are intended for comparative purposes only. Your rates may differ.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.