Credit Score Statistics

Your credit report is a reflection of your financial history and health. Previous and current debts, as well as open credit lines, can be found in your credit report. Different credit scoring models use this information to determine your credit score. And lenders, in turn, use your credit score and credit report to help determine whether or not they’ll lend you money or allow you to open a line of credit.

But how do credit scores vary among borrowers? And how do credit scores affect lender APRs? This study reveals various statistics on credit scores, from national averages to generational trends and more.

Key takeaways

- The average FICO score in the US is 704: FICO scores range from 300 to 850. So this is considered a good credit score and means most people have access to credit and debt products. (source)

- The average VantageScore in the US is 67X’ers have a lower average score than Baby Boomers.5: VantageScores follow a different scoring model than FICO scores and has become more popular over time in almost all aspects of lending, except for mortgages. (source)

- FICO is the most well-known credit scoring model: In fact, FICO produces multiple scores for different kinds of loan products. The credit bureaus have their own credit scores, including those which follow the FICO models. However, lenders, such as banks, also create various models they use for different combinations of products and borrowers. (source)

- Credit scores tend to rise with age: Older generations usually have the benefit of a higher average score than younger ones.

- Time is on your side: Partially due to changes in the model, scores have generally gone up over the past few years. That matches up with the score model itself, which takes length of credit history into account.

- There’s an inverse relationship between scores and APR offers: Traditionally, a higher credit score translates to a lower interest rate on financial products — but there can be exceptions.

- Location averages paint a picture: When you look at score averages by state, those scores vary from one to another, but there is one trend that sticks out: those from southern states typically have lower scores than individuals from other states. That same trend holds true when you zoom in on metro areas.

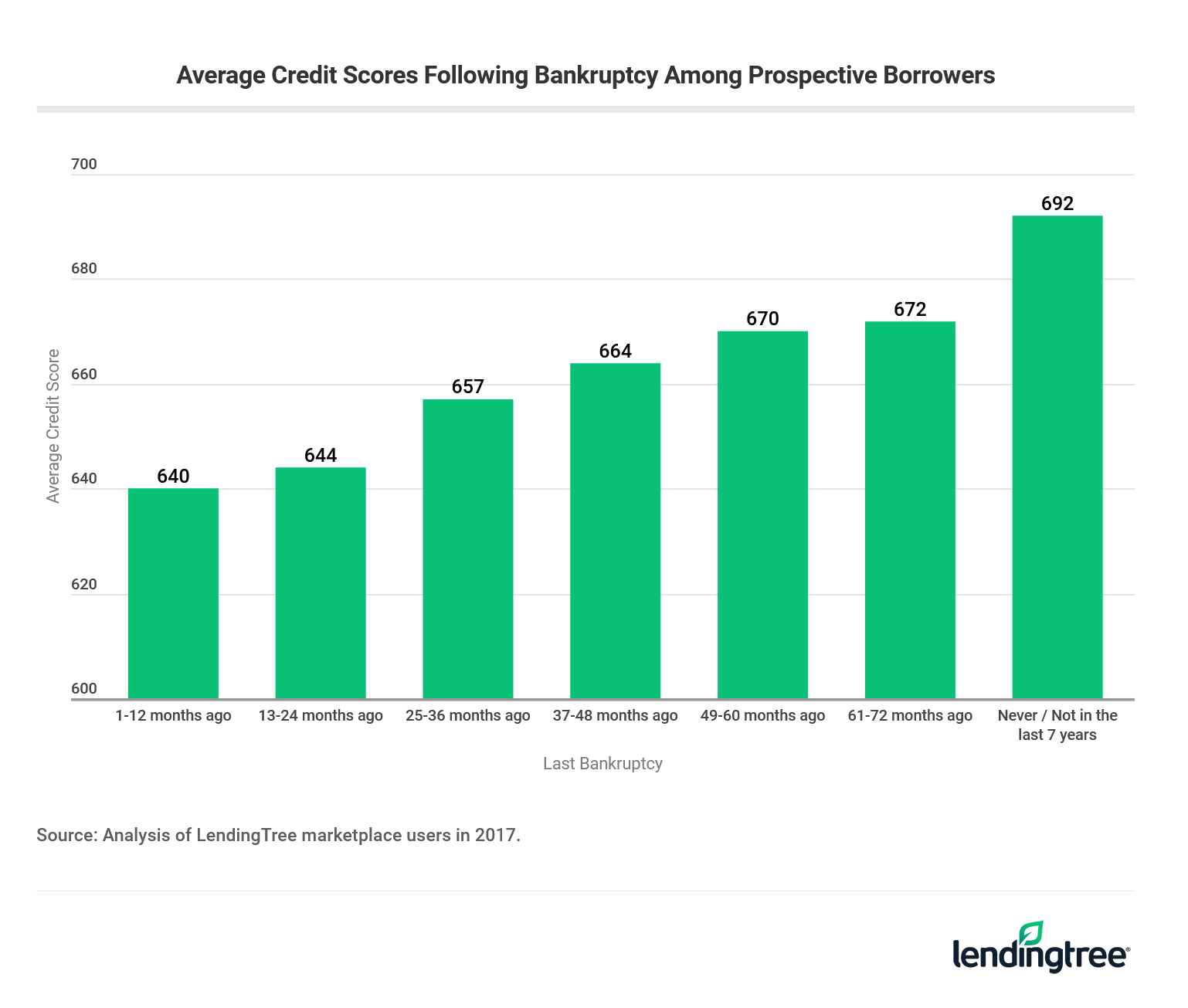

- Bankruptcy doesn’t mean it’s game over for your score: The more time that elapses following filing for bankruptcy, the higher an individual’s score tends to be. So rather than being the end, it’s the beginning of a journey back to solid credit.

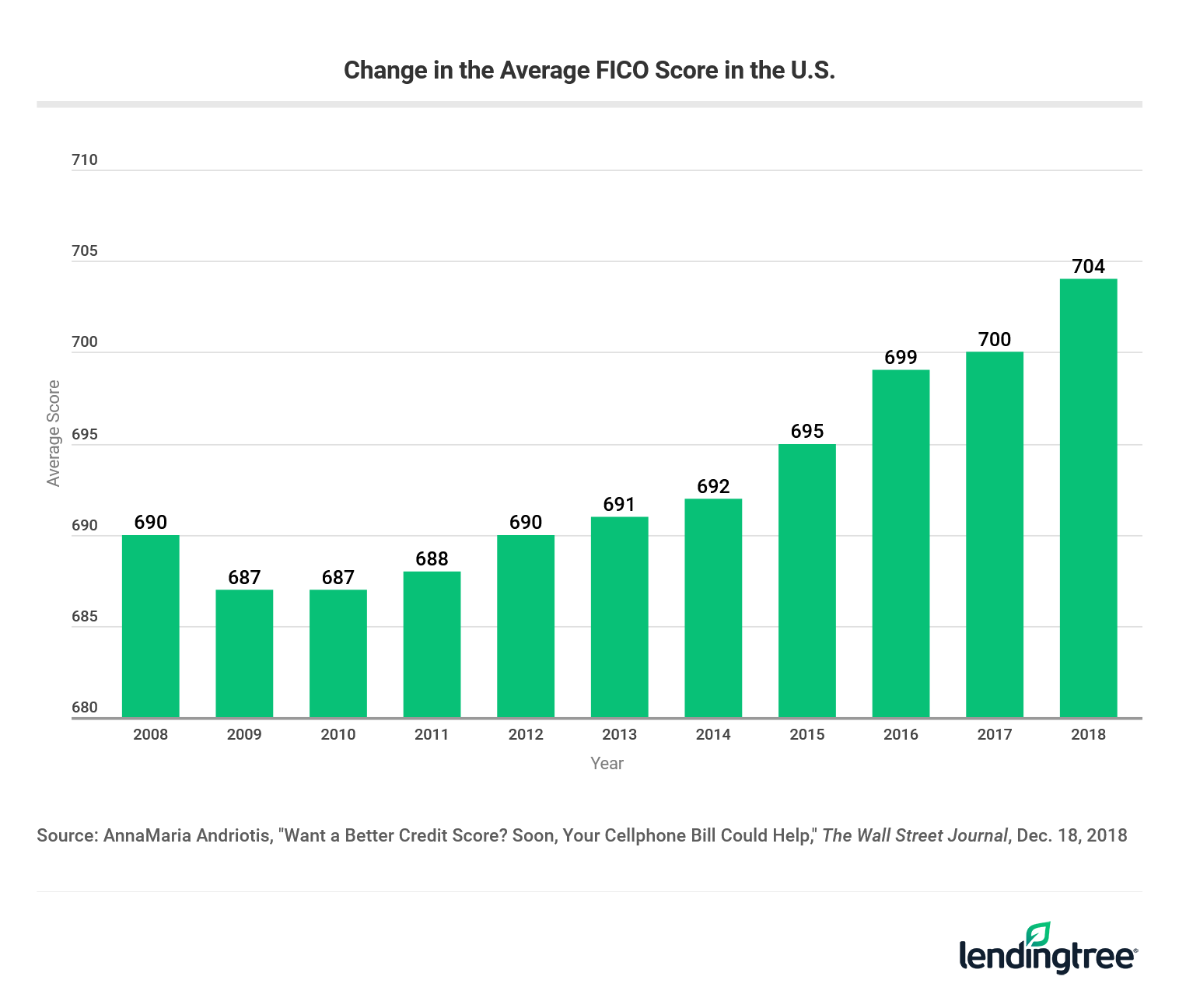

Average FICO scores over time

Following the recession, and the subsequent dip for the average score, there has been a steady trend toward a higher average credit score. But it’s important to note that rising scores may be due, at least in part, to changes in the FICO model.

Average credit scores by generation

Credit scores usually improve as the individual gets older, so older generations tend to have higher scores than younger ones. Millennials, for example, have a lower average score than those from Gen X, while Gen X’ers have a lower average score than Baby Boomers.

| Generation | Average Credit Score | Score Category |

|---|---|---|

| Millennial | 634 | Fair |

| Gen X | 653 | Fair |

| Baby Boomer | 696 | Good |

| Silent | 734 | Very Good |

Source: Analysis of an anonymized sample (July 2018) from among LendingTree’s 9 million users.

Average lender APR by credit score range

A higher score usually means a lower APR on products like mortgages, or personal and auto loans. And, in general, raising your score is more impactful for those with a lower starting score if you look at average APR offers. That means a person who starts at 550 and raises it by 50 points will experience a larger percentage point decrease in APR offers than someone who starts at 750.

Interestingly, however, there is an outlier when you look at the score tiers: The lowest personal loan APR offers from LendingTree partners actually went to those whose scores fell between 780 and 789, rather than those with the highest credit scores.

| Credit Score Range | Automobile | Personal | Mortgage |

|---|---|---|---|

| 550 - 559 | 17.34 | 108.37 | 6.17 |

| 560 - 569 | 16.53 | 100.81 | 5.53 |

| 570 - 579 | 15.79 | 94.62 | 5.53 |

| 580 - 589 | 14.58 | 76.10 | 5.37 |

| 590 - 599 | 13.68 | 69.14 | 5.39 |

| 600 - 609 | 11.17 | 58.04 | 5.32 |

| 610 - 619 | 10.60 | 54.37 | 5.30 |

| 620 - 629 | 8.63 | 44.86 | 5.42 |

| 630 - 639 | 8.08 | 40.02 | 5.41 |

| 640 - 649 | 7.93 | 37.33 | 5.32 |

| 650 - 659 | 7.63 | 34.75 | 5.31 |

| 660 - 669 | 7.27 | 29.36 | 5.22 |

| 670 - 679 | 6.50 | 28.02 | 5.20 |

| 680 - 689 | 6.33 | 25.28 | 4.92 |

| 690 - 699 | 6.11 | 23.84 | 4.89 |

| 700 - 709 | 5.87 | 22.07 | 4.82 |

| 710 - 719 | 5.67 | 21.14 | 4.81 |

| 720 - 729 | 5.50 | 19.62 | 4.73 |

| 730 - 739 | 5.37 | 17.71 | 4.71 |

| 740 - 749 | 5.24 | 16.77 | 4.64 |

| 750 - 759 | 5.13 | 16.39 | 4.62 |

| 760 - 769 | 5.00 | 15.49 | 4.61 |

| 770 - 779 | 4.97 | 15.13 | 4.61 |

| 780 - 789 | 4.90 | 14.77 | 4.61 |

| 790 - 799 | 4.90 | 14.95 | 4.60 |

| 800 or higher | 4.88 | 14.83 | 4.57 |

| Under 550 | 20.14 | 132.07 | 6.37 |

Notes: Offered APRs represent the average offers from lenders to prospective borrowers using the LendingTree loan marketplace, where borrowers can choose the lowest offered rate, which may be significantly lower than the average of all offers. Credit scores are single, although significant, factor lenders used to calculate interest and fee rates, and thus those with similar credit scores may receive different offers based on other elements of their financial profiles.

Source: LendingTree.com

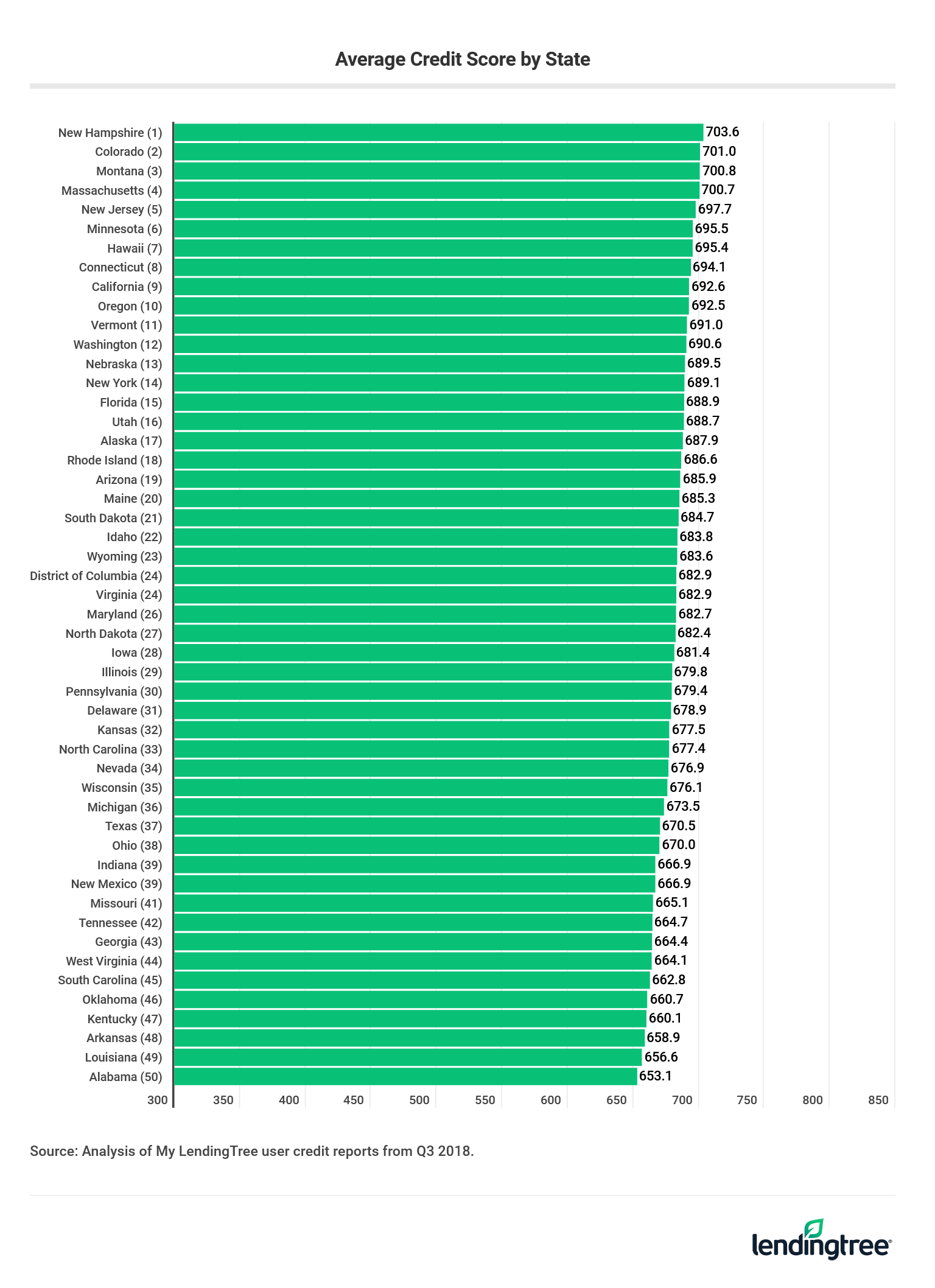

Average credit score in each state

When you look at the average score by state, the bulk of scores fall into the 670 to 690 range. Only four states had an average credit score of 700 or higher: New Hampshire, Colorado, Montana, and Mass. On the other hand, the lowest tend to come from the southern region of the U.S.

Average credit score in each American metropolitan area

Compared to statewide averages, metro areas have a much wider range of averages, spanning almost 100 points. Thirty-one metro areas from 15 different states have a score of 700 or higher. On the bottom end, however, the trend toward lower scores in southern states holds true for metro areas. The lowest averages came from areas in states like S.C., La., Ark., Ohio, Miss., Ga.

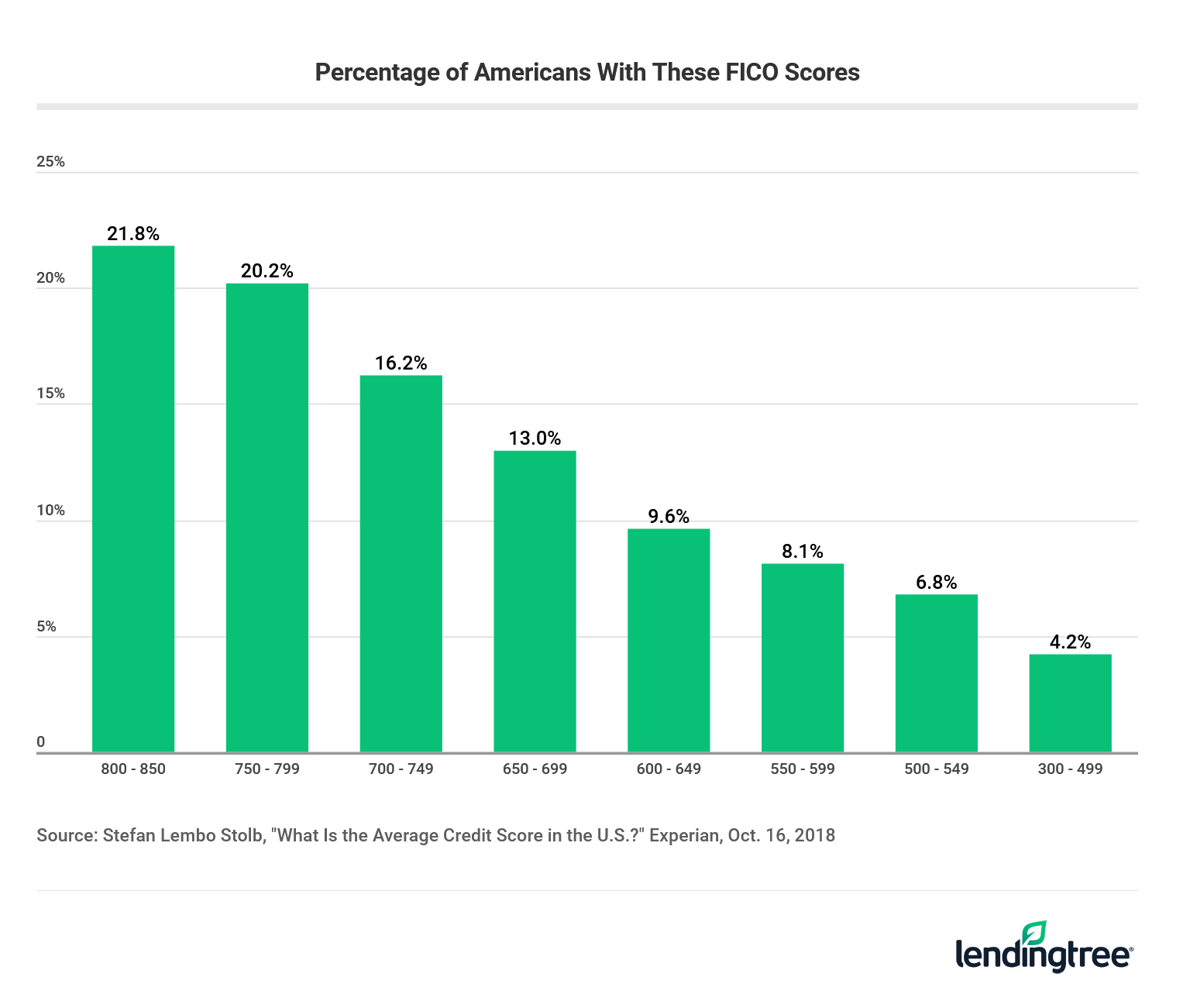

Percentage of Americans who fall within these FICO score ranges

The majority of Americans (58.2%) have a FICO score of 700 or higher. A score of 700-749 is considered “Good” while anything from 750 and above is considered “Excellent” by FICO score standards. Yet, nearly one in three Americans (28.7%) have a credit score of 649 or below. A “Poor” score ranges from 550-649 and a Very Poor score is 300-549. Scores within these ranges may only qualify for high loan rates — if they qualify at all.

How credit scores improve after a bankruptcy

Between Oct. 1, 2005 and Sept. 30, 2017, 12.8 million people filed bankruptcy petitions. Bankruptcy can help those who have been buried under debt. But bankruptcy isn’t the end for your credit score, as this chart reveals.

Understanding the various credit scoring models

FICO scores aren’t the only scores that matter, particularly when you look at non-mortgage financial products. Alternative scoring models and sources are on the rise, which ultimately impacts consumers and the products and rates they qualify for.

A person can, and likely will, have different credit scores depending on the scoring model. Lenders create various models which they may use with different borrowers and products. For example, a bank may use one credit or risk score model for a person who applies for a credit card online than they would if for a customer who walks into a bank branch to look for a credit card.

FICO isn’t the only score used for mortgages

Although it’s often believed that FICO is the only score used when assessing potential mortgage borrowers, that’s actually a myth. While it is the most commonly used score for mortgages, lenders also use other scores during the underwriting processes.

For example, lenders who make offers to loan shoppers on the LendingTree platform do so using a score from TransUnion, which is modeled on the FICO score (although mortgage lenders may later include FICO scores is the full underwriting file because Fannie Mae, Freddie Mac, and FHA require those scores). FICO’s continuing popularity among mortgage lenders is likely attributed to the rule that only allows Fannie Mae, Freddie Mac, and FHA to purchase loans based on their FICO scores.

Other scoring models used for other loan products

Financial products, like auto, student or personal loans, as well as credit cards, and even employers and prospective landlords may use non-FICO scores or methods. VantageScore, for example, follows a different scoring model than FICO and has become more popular over time in almost all aspects of lending, except for mortgages. (source) In 2017, the average American has a VantageScore of 675. (source)

Advances in data collection and analysis also mean that some lenders don’t have to use FICO scores to make fast (and cheaper) judgments about their creditworthiness, particularly when you look at non-mortgage products. (source) And when you look at non-traditional sources, like bank statements and utility payments, those are becoming more accepted as proof of creditworthiness, too. Even Experian, one of the three major credit bureaus, is starting to use those sources to better calibrate their own scoring model for those with thin credit histories. (source)

Credit scores aren’t the only factor considered

While credit scores are significant factor lenders use to calculate interest and fee rates, it’s important to understand that credit scores are a factor in that process, so those with similar credit scores may receive different offers based on other elements of their financial profiles. This is especially true of unsecured loans, like personal loans. But in the end, having a higher score can save a borrower serious money. A LendingTree study found that raising a credit score from “fair” to “very good” can save borrowers $45,000 over the lifetime of a common array of loans.

Must-see resources to raise your credit score

A credit score is like a financial resume that lenders use to help determine rates and terms on financial products. In general, the higher the score, the lower the APR offers you can snag. That’s why it’s important to raise it — even if you aren’t planning on applying for a mortgage or other loan right now, it’s an investment in your future.

That’s especially true when you consider how quickly a credit score can dip in the event of a single missed payment or closing your oldest account. Just remember that the process of raising your score is usually a long-term one, rather than a quick fix.

Interested in learning more about credit scores? Check out these resources to get started: